36+ mortgage how many years tax returns

Find A Lender That Offers Great Service. Expert says paying off your mortgage might not be in your best financial interest.

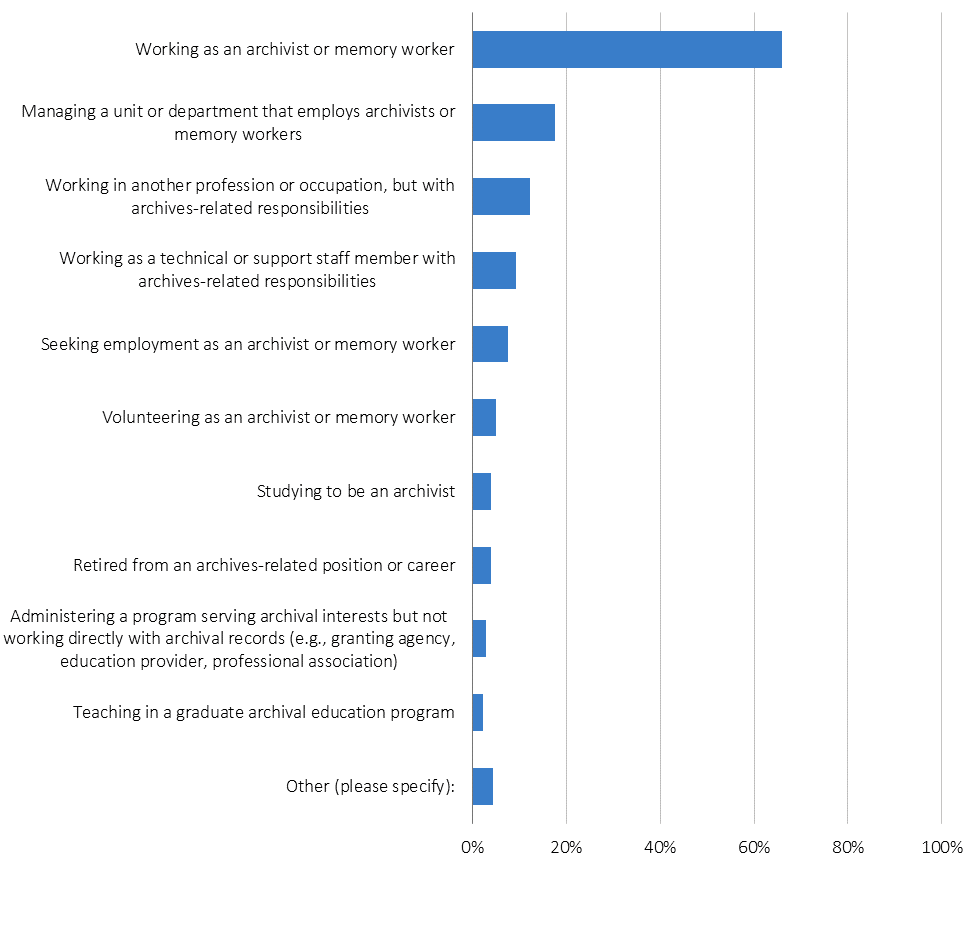

A Census Ii All Archivists Survey Report Ithaka S R

Ad Thinking About Paying Off Your Mortgage that may not be in your best financial interest.

. Lenders use your tax returns to confirm information provided in your mortgage. Web They want your total monthly debt obligations -- a figure that can include everything from your student-loan and auto-loan payments to your new estimated mortgage payment. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

Interest paid on the mortgages of. Web Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Its widely believed that you must have 2 years of tax returns in order to get a mortgage.

10 12 22 24 32 35 and 37. Web How you file your taxes has no real impact on your ability to qualify for a mortgage. Web Step 2.

As well as copies of the borrowers signed federal income tax return. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Fannie Mae requires that a.

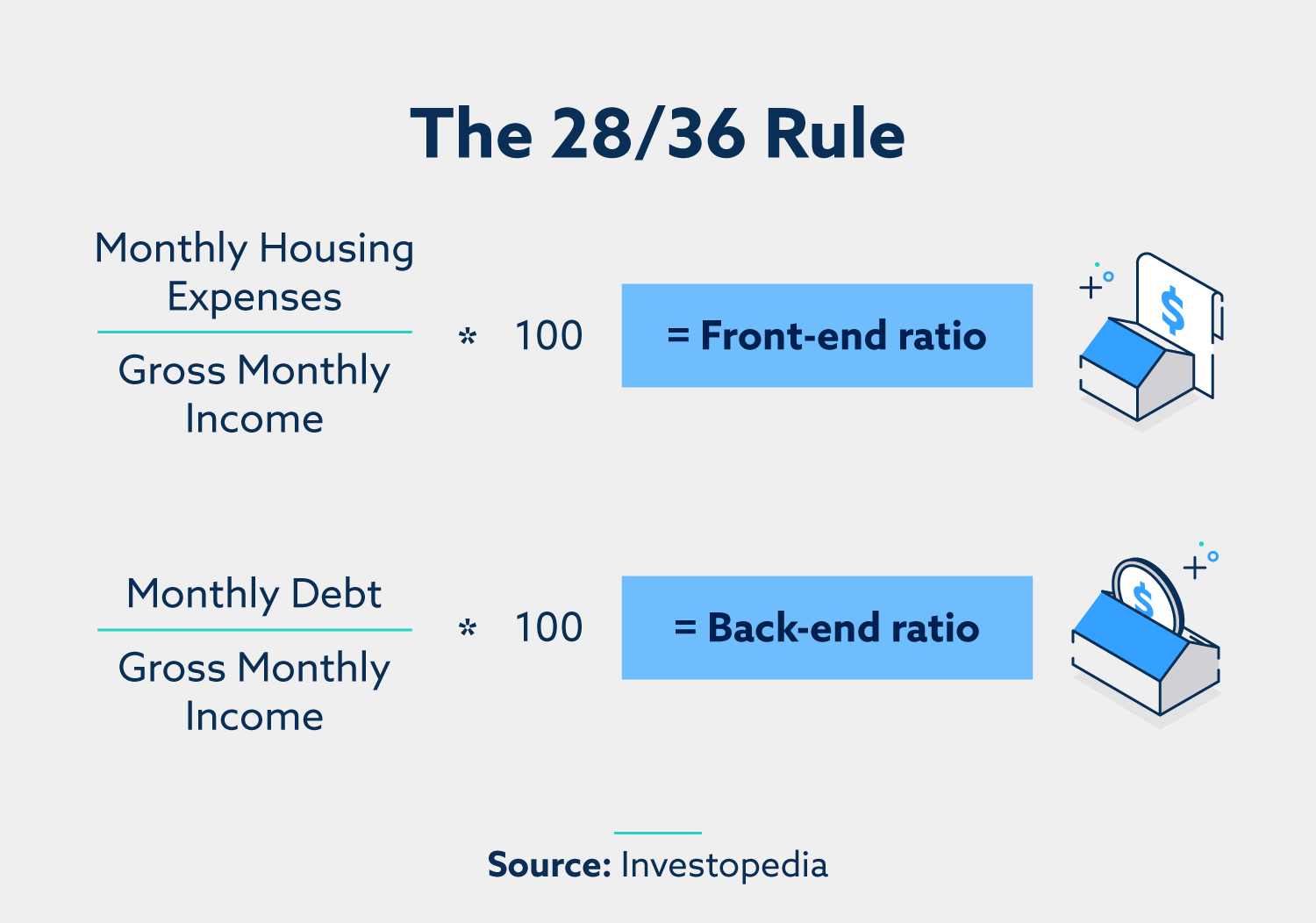

Web Web Period of Limitations that apply to income tax returns Keep records for 3 years if situations 4 5 and 6 below do not apply to you. Maximize your credit score. Fannie Mae requires that a borrowers DTI cant exceed 36.

Which of these brackets. While this is certainly. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

Get Your Max Refund Guaranteed. Web Fortunately some borrowers can use just one year of tax returns to qualify for a mortgage. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the home.

Ad Compare More Than Just Rates. Deduction for mortgage interest paid. But there are special rules to be aware of.

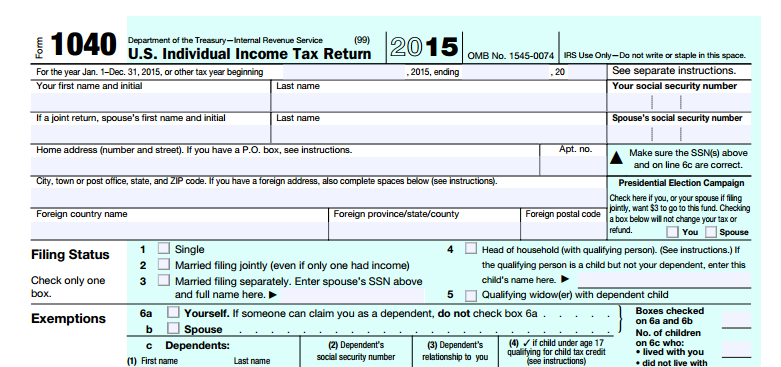

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Nearly all working Americans are required to file a tax return with the IRS each year. Web If you were issued a qualified Mortgage Credit Certificate MCC by a state or local governmental unit or agency under a qualified mortgage credit certificate program.

Homeowners who bought houses before. In this case the lender should request the. Web For the application you need 2 previous years of tax returns including your W-2s your pay stub for past month 2 months worth of bank statements and the lender.

Web 15-year mortgage rates. Web There are seven federal income tax brackets for the 2022 tax year taxes filed in 2023. Our Tax Pros Have an Average Of 10 Years Experience.

Lenders use tax returns or W-2s and pay stubs to confirm your income but your credit score helps them evaluate how likely. Web When underwriting a self-employed borrower DU or manually the lender should request two years of individual federal tax returns. Web Can You Get A Mortgage With Only 1 Tax Return.

Keep records for 6 years if you do not report income. Heres what you should know. Dont Leave Money On The Table with HR Block.

/cdn.vox-cdn.com/uploads/chorus_asset/file/6510321/56043648.jpg)

Trump Tax Returns In Norway Everyone S Tax Returns Are Public Vox

What Is The 28 36 Rule Lexington Law

Banking And Loan Businesses For Sale Bizbuysell

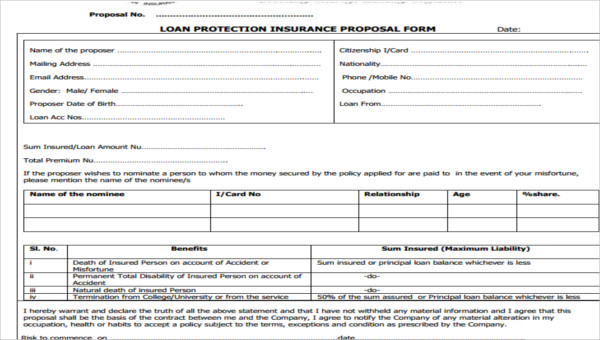

Free 11 Loan Proposal Forms In Pdf Ms Word

The 28 36 Rule How To Figure Out How Much House You Can Afford

Arizona Financial Services Businesses For Sale Bizbuysell

1013 Waterview Place Carolina Beach Nc 28428 Mls 100373185 Trulia

Documents You Need To Get A Mortgage

When Will I Get My Tax Refund Koin Com

Amazon Com Xtool D7 Automotive Diagnostic Tool 2023 Newest With 3 Years Updates 300 Worth Bi Directional Control Oe Full Systems Diagnosis 36 Services Abs Bleed Key Programming Oil Reset Epb Bms Automotive

Amazon Com Xtool D7 Automotive Diagnostic Tool 2023 Newest With 3 Years Updates 300 Worth Bi Directional Control Oe Full Systems Diagnosis 36 Services Abs Bleed Key Programming Oil Reset Epb Bms Automotive

425

Only 1 Year Tax Return Mortgage For 2023 Non Prime Lenders Bad Credit Mortgages Stated Income Loans

36 Application Letter Samples

Innovative Proptech Companies By Proptech Switzerland Issuu

834 Starvegut Lane Kennett Square Pa 19348 Mls Pact2029870 Listing Information Long Foster

Deductions U S 36 Expenses Allowed For Deduction Tax2win